Discover how merchant accounts simplify healthcare payments, boost cash flow, and improve patient billing for medical and dental practices.

Running a healthcare or dental practice means balancing patient care with managing cash flow. However, many practices struggle with patients paying late or in inconvenient ways. One industry report found that 78% of providers can't collect patient balances over $1,000 within 30 days. Slow payments throw off payroll and planning; contacting patients about payments takes time. The solution is simpler than you think: accepting electronic payments through merchant accounts.

Merchant accounts act as the bridge between your patients' payments and your regular bank account. Today, we'll explain what a merchant account is, how it works in a medical or dental practice, its key benefits, what to look for in a merchant account provider, and how BillFlash simplifies it. By the end, you’ll better understand why setting up a merchant account is foundational to modern, patient-friendly billing.

What Is a Merchant Account?

Merchant accounts are specialized bank accounts that allow businesses to accept and process electronic payment transactions. Unlike your regular business checking account, a merchant account is set up with an acquiring bank (often via a payment processor) to accept credit cards, debit cards, ACH, and other electronic payments. You typically sign up with a merchant provider (sometimes called an ISO or payment processor) that underwrites the account and sets up a relationship with the credit card networks.

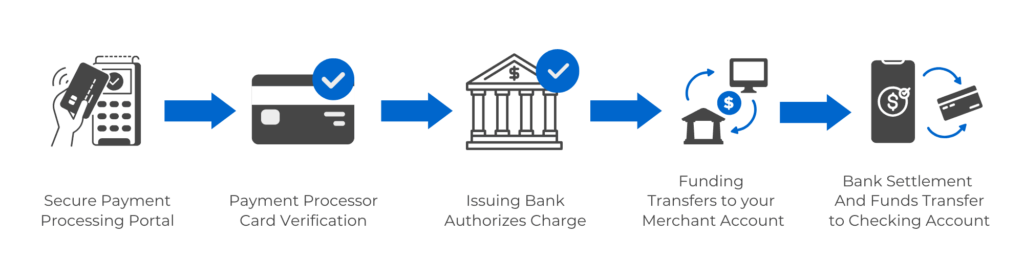

Unlike regular business bank accounts, merchant accounts help process card transactions. They temporarily hold funds from card payments before transferring them to your primary bank account. In the payment processing cycle, when a patient makes a payment, the transaction goes through a payment gateway, which then routes it to the merchant account. This happens behind the scenes, enabling fast, secure, and reliable payments.

How Merchant Accounts Work in a Healthcare or Dental Setting

Consider a typical scenario in your practice: A patient visits the front desk to pay a copay by card. A receptionist hands them the card reader terminal. Here's how the payment flows:

Patient Swipe/Tap (Gateway)

The patient swipes or taps their credit/debit card on the terminal. The terminal (payment gateway) encrypts the card data and securely transmits it to a payment processor.

Processor Verifies

The payment processor receives the encrypted transaction data and forwards it to the patient's issuing bank through the card network. The processor asks the bank if the card is valid and if funds are available.

Issuing Bank Authorizes

The patient's bank or card issuer checks the transaction. If everything checks out (such as sufficient balance or the card not being blocked), the bank sends back an authorization code. This approval flows back through the processor and gateway to your terminal, signaling that the charge is approved.

Funds to Merchant Account

Once authorized, the charged amount is moved from the patient's payment method into your merchant account. Merchant accounts hold the funds from card-based transactions before transferring them to the practice's main bank account. In other words, the money lands in your merchant account, not directly into your regular account first.

Settlement to Your Bank

At the end of the day (or on a set schedule), your practice (or your processor automatically) batches up all authorized transactions. The processor then settles the batch by instructing the merchant account to send the funds into your practice's standard business checking account.

Through this process, your practice receives patient payments quickly (much faster than mailed checks) and with layers of security. The payment gateway and processor handle encryption and fraud checks, and the merchant account is responsible for securely holding the money until settlement. Today, patient payments can be made through many channels. Patients can pay at the reception desk, online through a patient portal, on mobile devices, or even using flexible payment plans.

These channels will follow the same basic steps; only the interfaces differ. For example, if a patient clicks a “Pay Now” link from an email or text, the website's payment form serves as the gateway, but after authorization, the funds still flow into the same merchant account and then to the bank. In 2024, nearly half of patients used a mobile wallet, like Apple Pay, for a healthcare bill. Whether a card is swiped in person or patients pay through a patient portal link via text or email, merchant accounts are central to settling the payment.

Key Benefits of Having a Merchant Account

Using merchant accounts transforms how quickly and easily your practice receives payment. Here are some of the key benefits:

Faster Access to Funds

With a merchant account, funds from card payments are typically deposited into your account within 24-48 hours, compared to the longer wait times associated with checks or other payment methods. This speed helps to improve cash flow. A steady, predictable inflow of payments means you can cover payroll and other practice needs without long pauses.

Improved Cash Flow

Since payments arrive faster and more reliably, you can forecast revenue better. You won't need to scramble every month when insurance reimbursements or patient payments are delayed. Having funds settle quickly means you will spend less on billing reminders or third-party collections. Since today’s healthcare landscape demands immediate electronic payment options, offering them helps you avoid large unpaid patient balances that reduce your revenue.

Greater Flexibility

Merchant accounts let you accept nearly every payment method patients want. This includes credit and debit cards (Visa, MasterCard, American Express, etc.), ACH/bank transfers, and digital wallets like Apple Pay and Google Pay. Accepting multiple methods removes barriers for patients. For instance, a patient who prefers using Apple Pay can pay immediately if you offer it.

Increased Patient Convenience

Paying a medical bill should be as easy as shopping online. Patients are much more likely to pay promptly when they can use the payment method and channel they prefer. Research finds that 63% of patients will switch providers if their billing or payment experience is frustrating. This means providers who offer streamlined payment experiences will have more satisfied and loyal patients. BillFlash's payment solutions, for example, let patients save cards on file, apply for financing, and pay through a secure payment portal so it feels like a retail checkout.

Better Control and Reporting

With most merchant accounts, you get access to dashboards that show transactions in real time. You can easily see all transactions in one place, issue refunds, and manage disputes or chargebacks through the platform. Instead of looking through stacks of statements, you have a clear audit trail of every payment. A good merchant account gives you real-time visibility and control over transactions. From a single dashboard, you can generate statements and track key metrics. This centralized view helps you catch errors early and provides data to improve patient billing processes.

What to Look for in a Merchant Account Provider

Not all merchant account providers are the same. When choosing a partner for your practice, consider these key factors:

Transparent, Straightforward Pricing

Watch out for hidden fees or complicated contracts. A good merchant account provider will clearly state transaction rates, monthly charges, chargeback fees, and setup costs. You should know exactly what you pay per swipe, batch, or statement. Look for a provider that offers predictable pricing and lists all fees upfront. Avoid fine-print surprises by reading the agreement carefully. If costs aren’t transparent, high processing fees can quickly offset the savings from faster payments, making clarity essential.

Security and HIPAA Awareness

Strong safeguards are essential, even though HIPAA does not explicitly cover card processing. Look for PCI compliance, encryption, and secure storage. Look for merchant account providers who advertise HIPAA-aware practices, such as securely storing identifying data and not sending receipts in unencrypted emails. Choose a merchant account provider that will take every precaution (secure data centers, tokenization, PCI compliance, etc.) to protect patient information in line with HIPAA guidelines.

Healthcare-Specialized Support

Choose a provider who understands medical billing and patient privacy. They should be comfortable integrating with patient statements and supporting HIPAA controls. You’ll also want them to have experience working directly with medical and dental practices. Look for reviews and feedback from other practices. Providers who know medical billing software and can map payments to patient accounts will save you from major frustrations.

Multi-Channel Payment Support

Your merchant account provider should support every payment channel you need, such as in-office card terminals (EMV readers), an online patient portal, phone payments, and even mailed paper bills. Today's patients want options. For example, some can pay upfront online, some in the office, and some schedule auto-pay each month. Merchant accounts that offer a full online payment gateway (for eStatements and portal payments) and physical devices for point-of-service will cover all bases. Ensure the setup works with your workflow (e.g., patients can store cards for recurring payments). The more flexible, the better.

Billing System Integration

Finally, consider how the merchant account provider will plug into your existing systems. Does it integrate with your practice management or EHR/EMR software? Can it post payments automatically? Integration saves manual entry time. You will want a merchant gateway capable of importing and exporting data to your billing system and generating easy-to-read reports. Check if there are APIs or direct connectors. This way, credit card receipts flow straight into your billing system.

How BillFlash Simplifies Merchant Accounts and Payment Processing

While many providers offer merchant accounts, BillFlash takes a complete, healthcare-focused approach. BillFlash's platform unifies billing, payments, and collections into one system, and our payment module handles merchant accounts. Here's how we make it easier:

All-in-One Platform

BillFlash combines patient statement presentment with payment acceptance by offering a range of features designed to improve your payment processing:

- PreBill: Send PreBills to patients before their appointments, reducing the likelihood of late payments.

- eBills via text and email: Keep patients informed with electronic bills sent directly to their phones or inboxes via secure links. This gives them easy access to view and pay bills online through a user-friendly payment portal.

- PayReminders: Automated reminders that prompt patients to pay their bills on time. Your practice can send up to three text and email reminders monthly until the balance is paid.

- Integrated Collections Service: Manage collections efficiently with professional Recovery Specialists who help you recover outstanding payments.

Flexible Payment Channels

With BillFlash, your practice can accept payments anywhere patients are: in-office, online, or automated. Features like AutoPay let patients set up recurring payments; StoredPay securely saves cards on file (with PCI compliance), and PlanPay for patients approved for installment plans. All of these work through the built-in gateway. This means your patients can tap a card on an EMV reader or click a secure link sent via email or text, and both will go through the same merchant account.

Discounted, Integrated Merchant Accounts

BillFlash offers merchant accounts through select partners that can provide EMV terminals and advanced features like Card Account Updater, which automatically refreshes expired or replaced cards on file, so fewer payments decline. We also have a gateway-only option if your practice is already in a merchant contract. In this case, you keep your current merchant account but still get all the BillFlash features.

Simple Setup and Fast Funding

Onboarding is straightforward. Once approved, your account will be connected and provided with the card terminals or API integration needed. After processing through the merchant account, BillFlash Pay quickly deposits patient payments into your designated bank account.

Whether you need a full merchant account or want to connect your current provider through the gateway, you'll get flexible, secure, and healthcare-ready payment tools. Plus, you can view all payment transactions in real time. If a patient needs a refund, you can handle it directly in the system. Because payments and billing are together, your accounting stays accurate. If a patient's balance remains unpaid despite reminders, BillFlash lets you hand the account to collections.

Take Charge of Your Practice's Payments With BillFlash

Merchant accounts are a must-have for practices that want to get paid faster and give patients a more convenient experience. By making it easier for patients to pay you on their terms, you increase your revenue, reduce stress, and improve patient relationships.

With a solution like BillFlash, the entire process becomes easy. If you're ready to simplify payments and improve collections, we can help. Schedule a demo with BillFlash and see how our all-in-one billing, payment, and collection software, including merchant account support, can help your practice get paid faster and easier.